What are NFTs and Will They Last?

Will the NFT market continue to fly, or die?

April 13, 2022

In the past year or so, many questions have arisen about Non-Fungible Tokens, or NFTs, and exactly what they are.

Investopedia defines NFTs as “cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency” (Sharma).

Basically, these NFTs are one-of-a-kind digital assets for people. It is different from cryptocurrencies, as those are fungible, meaning that one Bitcoin, for example, can be replaced by another Bitcoin. But, NFTs are unique from one another like a piece of artwork.

For example, a very popular NFT is the Bored Ape Yacht Club which is worth about $300,000. Each of these images are of apes with their own unique traits. Many celebrities including Jimmy Fallon, Post Malone, and Steph Curry own this NFT. But what makes these cryptographic assets so expensive?

The fact that a certain piece of art or a digital image is an original piece is what drives the value up. Lifestyle Asia says, “Other factors that make NFTs such valuable investments are utility, ownership history, underlying value, perception of the buyer, liquidity premium and future value” (Basu).

So when did NFTs start? The history of the market started back in 2014. Kevin McCoy created the first NFT on May 3, 2014. “He minted his non-fungible token ‘Quantum,’ way before the crypto art market exploded” (Portion). Quantum sold for $1.4 million at Sotheby’s auction Natively Digital.

Also, most NFTs are not bought with the normal USD, but instead with Ethereum. Coin Desk defines it as “a blockchain-based software platform that is primarily used to support the world’s second-largest cryptocurrency by market capitalization” (Hertig). The cryptocurrency of Ethereum is Ether, which is second to Bitcoin in market capitalization.

Although, a question still remains of whether or not NFTs will remain popular or if the trend will slowly die out.

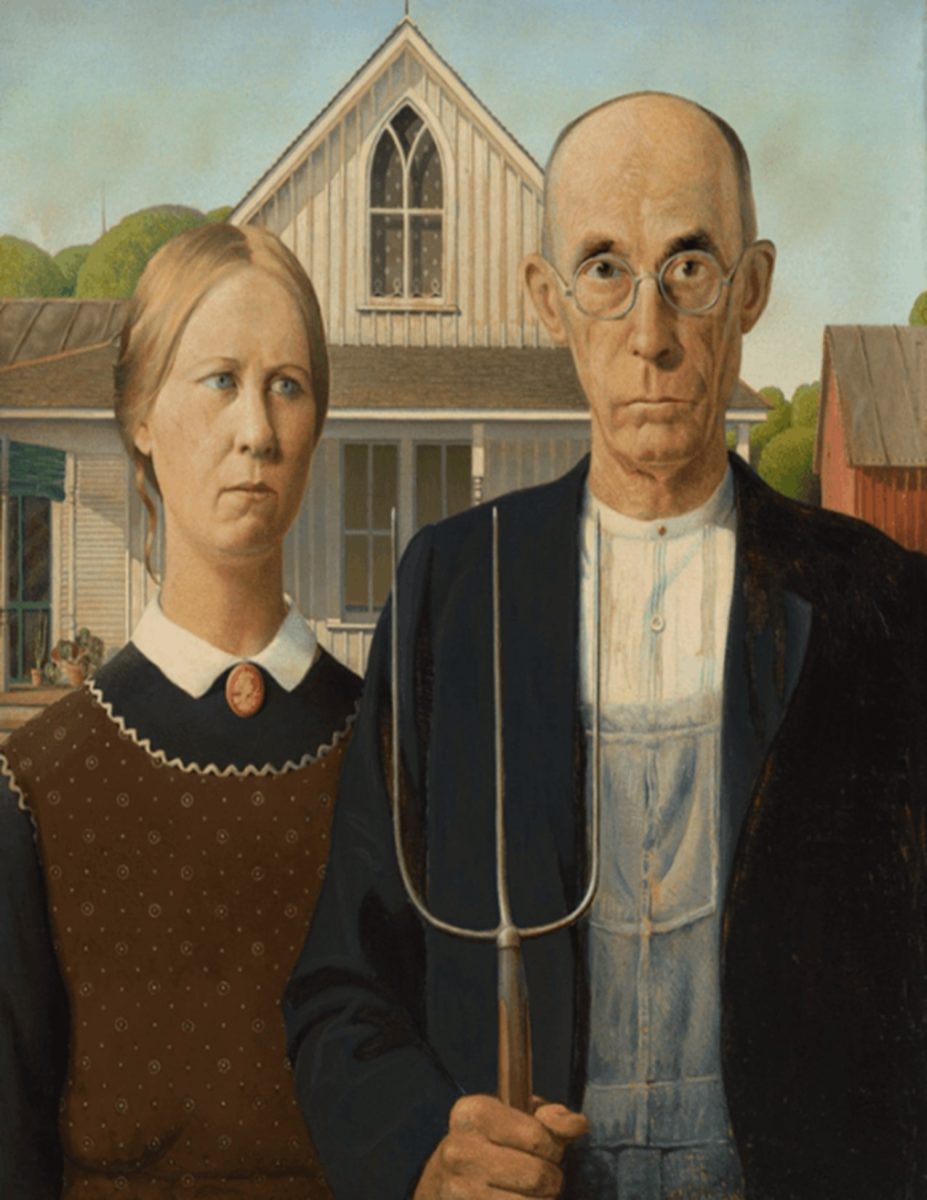

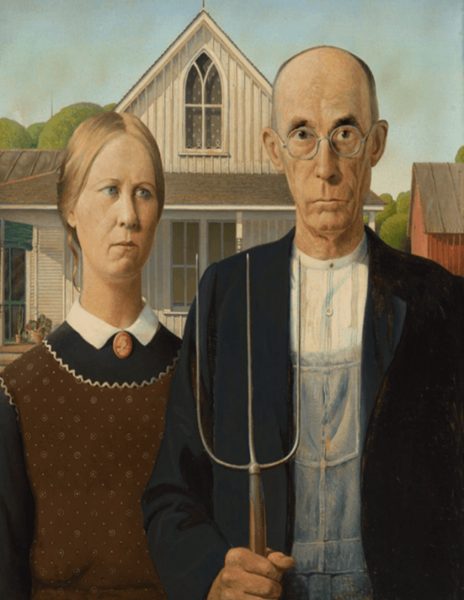

This could continue to be an expanding, profitable market. People may use these graphics as assets for centuries to come, just like a sports card or painting. For example, right now, an important asset could be a Tom Brady rookie sports card, or a painting by Pablo Picasso. But, possibly one-hundred years from now, it could be an NFT.

But, this topic is also somewhat similar to the Tulip Mania of 1634-1637. This is the story of the newly introduced fashionable tulips in Holland that gradually accelerated in prices, then quickly crashed a few years later. In 1634, there became an obsession with tulips in Holland. So, as the demand for tulips increased, the prices increased too. They became so valuable that “the best of tulips cost upwards of $750,000 in today’s money” (Hayes). Soon after, in 1637, the buyers were unable to pay these unbelievable rates, so the tulip market crashed and prices went down drastically.

There is a saying that history repeats itself. So, on the topic of NFTs, people may think it is not worth paying these large sums of money for a digital image. And in a few years time, the NFT market could possibly crash leaving many people devastated with their purchases.